Marktrisiko richtig einschätzen, Maßnahmen ergreifen und Chancen nutzen.

Market Risk Evaluator

Automate market risk management with ease.

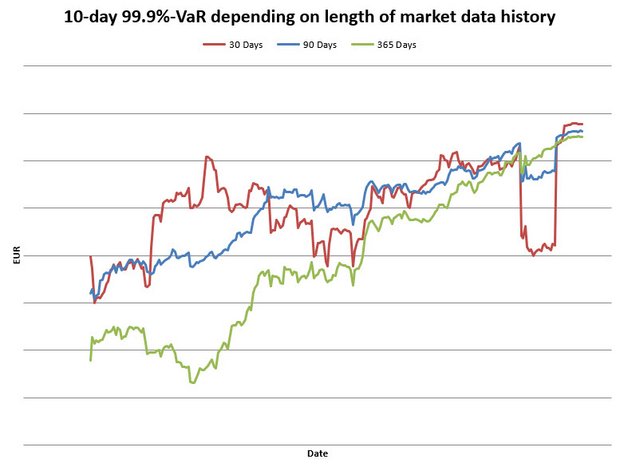

Market prices, interest rate risks, foreign currency risks and many other market factors - the topic of "market risk" is a broad field. It is made easier by the Market Risk Evaluator, which offers the possibility to fully automate analyses and reporting. Data from different interfaces and data points are standardised without your intervention. This consolidated market data is the optimal basis for Monte Carlo simulations. In combination with scenario analyses, stress tests and validation, the tool covers the complete market risk management process. In addition, you fulfil the regulatory requirements for credit banks. Use the advantages of the Market Risk Evaluator to relieve your team and react to current market situations.

Advantages

- Daily automatic calculations possible

- Current development of the portfolio always visible

- Consolidation of missing data, risk elements and risk parameters

- Different cash flow calculations, operational and indirect

- Different simulation models

- Optional automatic and manual batch processing

- Calculations based on historical market data and portfolios possible

- Portfolio and market factor backtesting

- Easy search and application of stress periods